Ben Bernanke, Douglas Diamond and Philip Dybvig. The award was given for the laureates role in improving our understanding of the role of banks in the economy, particularly during financial crises. The Nobel website summarizes their contribution as follows:

For the economy to function, savings must be channeled to investments. However, there is a conflict here: savers want instant access to their money in case of unexpected outlays, while businesses and homeowners need to know they will not be forced to repay their loans prematurely. In their theory, Diamond and Dybvig show how banks offer an optimal solution to this problem. By acting as intermediaries that accept deposits from many savers, banks can allow depositors to access their money when they wish, while also offering long-term loans to borrowers.

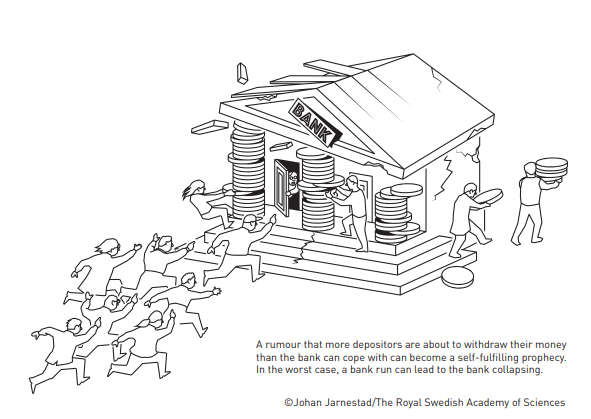

However, their analysis also showed how the combination of these two activities makes banks vulnerable to rumors about their imminent collapse. If a large number of savers simultaneously run to the bank to withdraw their money, the rumor may become a self-fulfilling prophecy – a bank run occurs and the bank collapses. These dangerous dynamics can be prevented through the government providing deposit insurance and acting as a lender of last resort to banks.

Diamond demonstrated how banks perform another socially important function. As intermediaries between many savers and borrowers, banks are better suited to assessing borrowers’ creditworthiness and ensuring that loans are used for good investments.

Ben Bernanke analyzed the Great Depression of the 1930s, the worst economic crisis in modern history. Among other things, he showed how bank runs were a decisive factor in the crisis becoming so deep and prolonged. When the banks collapsed, valuable information about borrowers was lost and could not be recreated quickly. Society’s ability to channel savings to productive investments was thus severely diminished.

While some were critical of the bank bailouts during the Great Recession, the Bernanke point of view was that how propping up failing banks was necessary to stave off an even deeper economic crisis. Other summaries of the authors contributions can be found at NY Times, Marginal Revolution, BBC, WaPo and many more.

Does Bernanke’s research have relevance for our current times? Certainly so. From Marginal Revolution:

Bernanke’s doctoral dissertation was on the concepts of option value and irreversible investment. Modest increases in business uncertainty can cause big drops in investment, due to the desire to wait, exercise “option value,” and sample more information. This work was published in the QJE in 1983…

Here is Ben with co-authors: “We first document that essentially all the US recessions of the past thirty years have been preceded by both oil price increases and a tightening of monetary policy…”