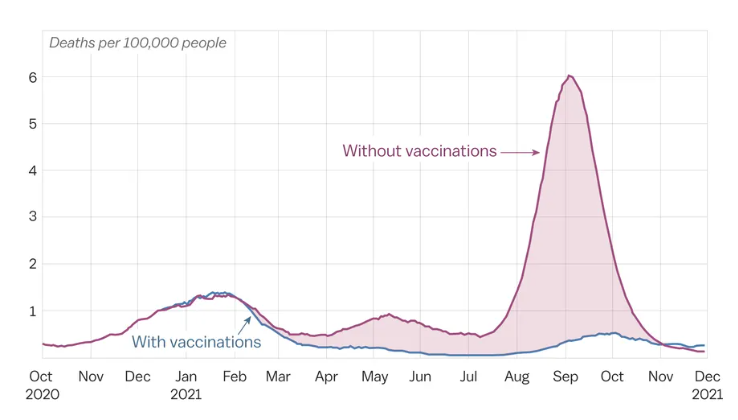

COVID-19 vaccines have had a huge beneficial impact on patient health. One study found that between December 2020 and June 2021, COVID-19 vaccines saved 240,000 lives (Vilches et al. 2022). The figure below shows that as the Delta and Omicron variants spread in the fall of 2021, COVID-19 vaccines prevented significant number of deaths according to Vox.

A study by Ahuja et al. (2021) found that increasing the total supply of COVID-19 vaccines at the start of the COVID-19 pandemic from 2 to 3 billion doses would have generated $ 1.75 trillion in social value.

Despite these positive impacts, a number of political commentators have been accused of pharmaceutical companies of profiteering. Some analysts predicted that life science companies would make $ 100 billion in COVID-19 sales and $ 40 billion in post-tax profits. Yet is making mRNA vaccines for emerging diseases a sure way to earn huge returns?

According to a recent NBER working paper by Barberio et al. (2022) the answer is a resounding ‘no’. In fact, in most cases, developing mRNA vaccines for a portfolio of emerging diseases would be a money loser. The authors find taht:

We analyze the financial performance of a hypothetical portfolio of 120 mRNA vaccine candidates in the preclinical stage targeting 11 emerging infectious diseases. We calibrate the simulation parameters with input from domain experts in mRNA technology and an extensive literature review. We find that the portfolio generates an average annualized return on investment of –6.0% per annum and a net present value of – $ 9.5 billion, despite the scientific advantages of mRNA technology and the financial benefits of diversification. Clinical trial costs account for 94% of the total investment, with manufacturing costs accounting for only 6%. Sensitivity analysis reveals that the most important factor determining financial performance is the price per dose, while the increased probability of success due to mRNA technology, adjusting the size of the portfolio, and the possibility of conducting human challenge trials do not significantly improve financial performance. These results underscore that if the goal is to create a sustainable business model and robust global vaccine ecosystem, continued collaboration between government agencies and the private sector is likely to be necessary.

Due to the fact that clinical trial costs are high and most emerging infectious disease incidence / prevalence is highly uncertain (ie, most do not result in a pandemic) the return on investment for these vaccines is low. Looks like a case where profiteering is in fact not very profitable.