[ad_1]

I love hearing how other people organize their money, so here’s a glimpse into my YNAB budget categories!

This one’s for the Budget Nerds!

This post will probably not appeal to the majority of you who do not use YNAB. But those who do – you will love it! This one is for the budget nerds out there, like me. I LOVE the YNAB Budget Nerds Podcast hosted by Ben and Ernie. You can find it here on Apple Podcasts, here on Spotify, and here on YouTube!

Last fall they aired an episode featuring Lee, who went line-by-line through his budget and shared his category structure including everything from emojis to why he chose certain category names. I completely geeked out over the episode. So much so that I emailed Ben and Ernie and told them I would enthusiastically love to be on the podcast to do the same thing! Much to my surprise, they agreed, and this week we will be recording the episode. I will let you all know when it is published!

What a budget tells you

While some of you may already be falling asleep at your desk, others of you might be curious what’s so cool about seeing someone’s budget. What you spend your dollars on reflects what you value. While I won’t be sharing real numbers (that would be the juiciest, wouldn’t it?!), by sharing my category groups, names, and spending plan, you can get a good idea of what I value most. Moreover, I have STRONG opinions about how I organize my budget. I hope you can feel my excitement on this topic wafting off the page!

Our Household Snapshot

In case you are new here, here’s a snapshot of our household to help understand our budget:

- Married couple in our 40s

- Two incomes, each small business owners (I’m a blogger; he’s a general contractor)

- Two kids, ages 11 and 5

- Joint checking with a side account for Thomas’s fun money

- I’m the “money person” so I do most of the YNABing!

What is YNAB?

I’ve been using YNAB since I was first introduced in a sponsored post opportunity in 2016. Here is my first impression post and what I learned after 6 months of using it. I even created our wedding budget in YNAB, and I use it for my business expenses, too. I absolutely love that it lets you divide your money into a pie, plan for the future, and know in an instant exactly what money is set aside for what goal. If you haven’t tried it before, my link will get you a free month. I honestly cannot imagine life without it – I feel that strongly!

How I organize my budget

I love to organize things, and organizing our joint checking account is no different. Before I start to go through my categories, I wanted to take a minute to talk about how I organize my budget. I have listened to others talk about their category groups (on podcasts, YouTube, etc.) and I have tried a lot of different strategies: no groups (one long alphabetical list), groups by topic (food, kids, pets), and groups by transaction type or date.

Ultimately, I like mirroring Ramit Sethi’s guidelines in his conscious spending plan divided into: fixed costs, short term savings, guilt-free spending, and investing. These four buckets as percentages are a great guideline to follow for a solid financial position, and I like knowing the number we spend in each group off the top of my head. Combine my monthly and annual expenses together for fixed costs and then add savings and travel together for short-term savings.

My Category Groups:

- Savings (at the very top, to encourage growth!)

- Spending (all wants)

- Monthly Expenses (needs, goes to zero each month)

- Annual Expenses (needs, carries a balance each month, has a target)

- Travel (all wants but needs its own group due to high cost when used)

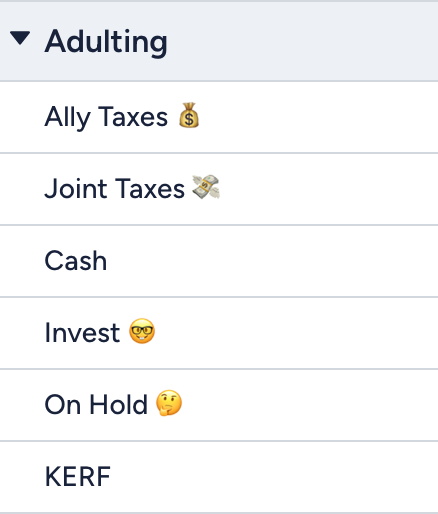

- Adulting (holding / reporting categories that rarely get money assigned)

Generally these go down the page from most to least used / significant:

- Savings gets the top spot because I want to feel the most motivated by it growing! I also think the psychology of seeing it most often reminds me of my goals when I open my budget to spend.

- The Spending group is near the top for easy access because it’s the one I access and spend from the most.

- The Monthly Expenses group is mostly automated, but I do check to make sure transactions are coming out and the balances are going to $0.

- The Annual Expenses group gets the least action because these are lumpy / true expenses that are sinking funds for things that are necessary and expected but once or a few times a year expenses. I check this section the least of the four mentioned.

- Travel is near the bottom, but it gets pinned to the top if we are on a trip. Technically, this is part of the short-term savings group, but I like to pull it out because it’s so discretionary compared to cash reserves.

- And the Adulting group is really just a way to track money that flows through my budget for taxes, investing, or reimbursements.

Emojis

In the YNAB world, there are some strong opinions about where the emojis go! I have to have mine at the end of the line. I have tried the beginning and hated it because it took my eye too long to find the word to read. But I do love having the color and symbol of an emoji there, so I have them on almost all of my categories. The emoji is strategically chosen, of course 🙂

My YNAB Budget Categories

So let’s go through each category group and see how the pie is split up!

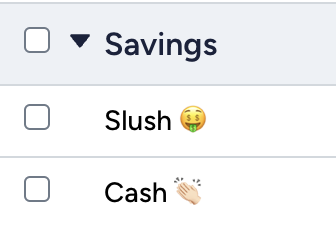

Savings

The Savings category group is at the very top of my budget to be a constant reminder of the most important thing: saving more! There are two main buckets here:

- Slush is the bottom of my checking account. I keep a base amount of cash here as a buffer so that we’re never getting close to $0 if all bills are paid on the same day. I also use this Slush to cover overspending and then top it back off the following month. I like for it to be an even whole number at the beginning of the month so I am less tempted to take from it. That forces me to whack-a-mole (WAM) other categories before taking from the slush.

- Cash is our emergency fund – aka cash reserves. I used to have it labeled emergency fund but seeing the word “emergency” at the top of my budget was alarming, so I changed it to cash which has a nice cozy and safe feel! The goal for the Cash line is for it to grow and for extra to get skimmed off the top for non-retirement investments or fun spending, like a trip.

This cash reserves are held in a 5% high-interest savings account. While I’m very happy to be earning interest on this money, having a separate account to transfer in and out of goes against the simplicity I try to fight for.

Our retirement investments come out of our paychecks / businesses, so I don’t have a line item for those at the top, but I DO filter some of them through our joint checking account as transfers (from my business to my Solo 401k account or investment account) so I have a line in Adulting for Retirement for tracking purposes. See more on that below!

Spending

Wants vs. Needs

Now the fun stuff: Spending! I mentioned above that my category groups are balanced between “wants” and “needs” because I like to be able to know off the top of my head what dollar amount we spend per month is discretionary. This helps me have an idea of what our baseline fixed expenses are and what we could cut out if we needed to. I am constantly fighting the balance of simplicity and data. I’ve experimented with breaking our spending into sub groups and that just complicated things. All I really need to know here is this whole group is discretionary!

Where is Thomas?

You might think that my husband has no fun money. On the contrary! He has a personal checking account that gets funded each month directly from his paycheck. Since he is not in the weeds of the budget day to day like I am, it works out perfectly for him to have his own place to play. I never have to see his transactions, which is great because I’d probably question them all! Haha. He pays for haircuts, golf, gifts, lunches out, and toys with his account.

Assigning Money

This category group has the most variation month to month. Sometimes I don’t even fund a line (like Spa – that one gets the least attention!). There is also the most WAM happening between these categories, stealing from dining out to buy something, or most often not buying something because we dined out too much! I feel strongly that these categories go to zero at the end of the month so that I can refund them the next month and keep our assigned money even. My goal is always to have something left to roll into savings, but that doesn’t happen much.

Dining Out

At one point I tried to divide up Dining Out into: Kath lunches, date nights, family meals, and bars and it was just too much dividing! I wanted the data, but I didn’t want to have to micromanage the categories, so I ended up rolling everything back into a big Dining Out category.

Family Spending vs. Activities

Family Spending includes purchases that benefit us as a couple that are not necessary purchases. Frivolous things. Consumable things like a new NA wine to try. Tickets to concerts that we go to together, etc. Activities, on the other hand, are family-friendly fun things we do with the kids. Movies. Ice cream (it’s more of an activity than a food!). The trampoline park. Etc.

Gifts

Lastly, Gifts is our giving category. We sponsor a family through Holt International and that is a regular expense. And then there are birthday/wedding/baby shower gifts. And then there are giving opportunities like to support people’s causes. That all goes under this category. The two gift types that don’t go under here are Birthdays and Christmas – those are annual expenses below!

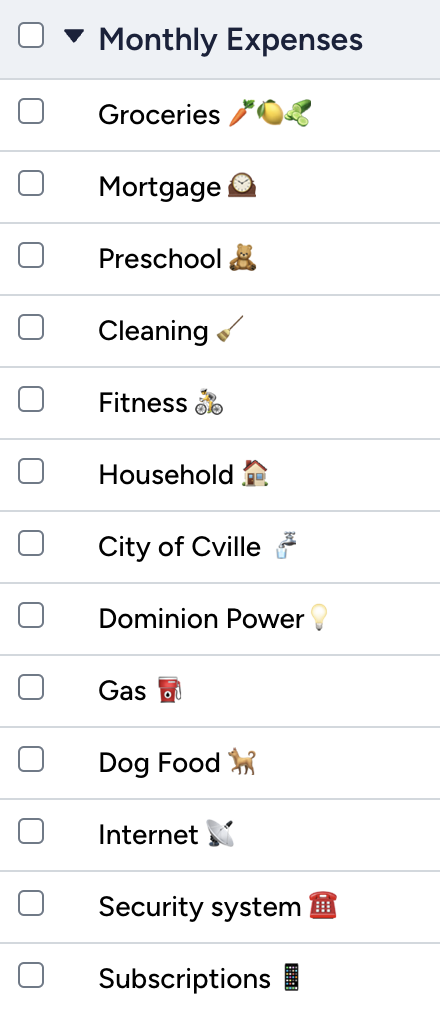

Monthly Expenses

The Monthly expenses group is about as boring as they come. The “big three” are at the top – Groceries, Mortgage, Preschool. We only have a few more months of paying for preschool, and that will be such a huge celebration for the budget! These categories get funded pretty evenly month to month, and every category should be zero at the end of the month. That’s how I can keep an eye on what bills have been auto-drafted since most of these are auto-drafted. The only category that is somewhat flex in here is Household, which is where I put all 100% necessary house purchases, like toilet paper or laundry detergent. I have debated putting those with Groceries, but I do like keeping the food separate.

I have Fitness and Cleaning in this category which you may think are “wants” not “needs” but they are here because they are the last things we would let go of in an emergency life situation. Fitness covers our gym membership and Peloton which is different from the Sports category in annual expenses below.

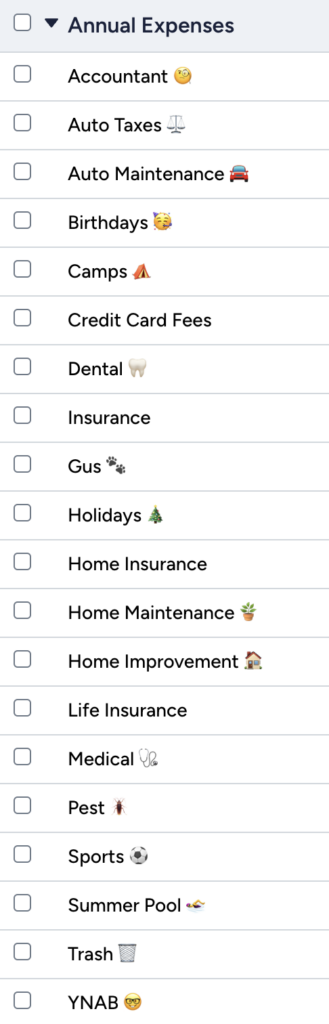

Annual Expenses

This category includes all the surprise expenses that shouldn’t really be surprises! YNAB calls these lumpy, often annual expenses, “True Expenses.” They are sinking funds to pay for things that you know are coming (Insurance every August! Christmas every December!). These are a mix of wants and needs, but I’d say they lean on the needs side, so I consider them part of my fixed expenses.

Life is Lumpy

On Choose FI, Brad likes to say “life is lumpy.” My goal is life is a smooth budget with no lumps! While of course there will be some unexpected expenses along the way, if I can plan for it, I want to plan for it. We pay our accountant, auto taxes, credit card annual fees, insurance, vet bills, pest control, summer pool, trash and YNAB (!!) once or twice a year. I used to hate it when a “lumpy month” happened. But since falling in love with YNAB, I’ve prorated everything! These categories all have a YNAB Target set so I just click one button to fund 1/12 of the amount I need each month.

Birthdays and Holidays

More recently I turned these into Annual Expenses. Save $100 a month for 12 months and you have the cash for all of your holiday giving. The same for our birthday season (Q4!).

Dental and Medical

I am not one of those people who keeps their whole family deductible sitting in my medical budget. I usually see what appointments we have coming up and put some dollars towards them, plus one extra visit if someone was sick. If we were to have an ER visit or bigger expense, I’d use my cash reserves (emergency fund) and then work to replenish that after. For dental, I take the four of us and the cost of our appointments and add them up, and then divide by 12.

Gus The Dog

I have the predictable dog food in the Monthly category, so this line is for anything lumpy that Gus needs – his annual vet bills, flea medicine, and 2 weeks a year of dog sitting when we travel.

Sports

I keep sports and fitness separate because of the kids’ sports. The fitness category in monthly is our gym and Peloton. We have no intention of ever cancelling them. But this sports category covers registration fees for 2 adults of year round soccer. And then the kids fees are in there as well for spring and fall.

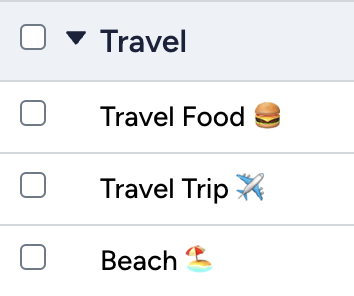

Travel

This could easily be grouped into Savings or Annual Expenses or even the Spending group, but it is separate because it’s the one area where I do like to have some extra reporting and it tends to be super lumpy! We don’t travel every month, so I don’t want it cluttering the top of the budget OR mixed into the “needs” section because travel is 100% a want. Thus, it gets its own area. I have experimented with budgeting a monthly amount to this category, but if we don’t have a trip planned, then I end up just WAMing that money elsewhere. So I don’t budget to this category until we have a trip planned (usually at least a few months out).

Also because we use credit card rewards for most of our base travel, the travel category isn’t as baller as it would be if we used all cash! We are mostly budgeting for food on trips and some incidentals for the travel part (airport parking, etc.) so that’s why I separated out food and trip.

Lastly, we do usually take a family beach trip every summer that is a predictable, regular amount that I prorate all year, so that beach trip gets its own category. I want to know that I can spend the travel trip to zero if I’m on another trip and never want to be doing mental math to subtract out funds reserved. Beach has been in the Annual Expenses group before, but it moved under Travel when I decided to get better about reports.

Adulting

Think of the Adulting category as a reporting / transfer group more than a group where I assign money each month.

- Ally + Joint Taxes: The two taxes lines are for holding and paying estimated quarterly taxes for my business. The name signifies which account they are in (I move them back and forth from the Ally account because that’s the 5% interest account! Sometimes I miss just having one account at zero interest, hahaha).

- Cash is cash out of the ATM, which I rarely get. If I do, it’s often for a babysitter or a gift, so it goes in that category. This cash line is mostly if I just randomly get some out but don’t know how I’ll spend it.

- Invest is an obvious one – it’s any money we send to the investment account.

- On Hold is a line item for reimbursements. A few years ago I was in charge of paying for the family beach house and my fam venmoed me large sums of money. I didn’t want it to mix with mine, so it parked it in here.

- KERF is a line item in case a KERF expense runs through the personal budget. It happens.

Focus Groups

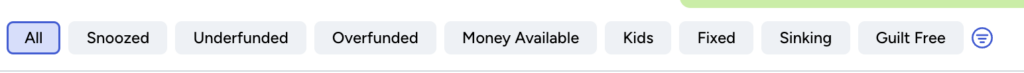

YNAB has a new-ish feature called Focus Groups, and they are awesome because they allow you to group categories together that you might have in a different group structure in your budget. I created some of my own:

- Kids expenses – pulled from all different groups

- Fixed – combines monthly and annual expenses

- Sinking Funds – all savings accounts without a clear expense timeline (aka Birthdays, Christmas, Car Maintenance)

- Guilt Free – pulls all the spending from all the categories despite the assigned group

I love the ones YNAB has auto-populated too!

There you have it!

If you made it to the end of this post, great job! You must be a huge nerd like me!

If you have questions about my categories, budgeting in general, or have strong opinions about why your structure is the best, please write a comment!

More Financial Blog Posts:

[ad_2]

Source link