[ad_1]

CMS released a guidance on June 30, 2023 providing additional detail on how the maximum fair price (MFP) will be calculated. The document also has nearly 100 pages of public input comments. A summary of some key points are below. Of most interest is that CMS is taking a ‘reference price’ based approach to setting MFP.

- Setting MFP with reference pricing. “CMS will use the Part D net price(s) (‘net price(s)’) and/or ASP(s) [average sales price] of the therapeutic alternative(s).” CMS says it will then consider adjustments based on other factors, but it appears that reference pricing is the primary means for setting MFP. CMS said it will “take a qualitative approach” to adjusting the starting negotiation price based on the unique characteristics of the drug and its therapeutic alternatives. Additionally, note that CMS will consider the prices of generic and biosimilar products in the bundle of therapeutic alternatives. If there are no therapeutic alternatives, CMS will consider a starting negotiating price based on the FSS or “Big Four Agency”66 price (“Big Four price”).

- No use of QALYs. CMS explicitly stated that it would not use quality-adjusted life years (QALYs) as part of MFP. What will they consider? Outcomes such as cure, survival, progression-free survival, improved morbidity, improved symptoms or patient reported outcomes could be considered.

- Productivity impacts. CMS said that it will include productivity impacts for patients, but is not considering productivity impacts of a treatment on caregivers.

- Caregiver perspective. CMS said that they “…may also consider the caregiver perspective to the extent that it reflects directly upon the experience or relevant outcomes of the patient taking the selected drug.” It is not clear how caregiver burden would be taken into account if only this is relevant to the patient taking the drug.

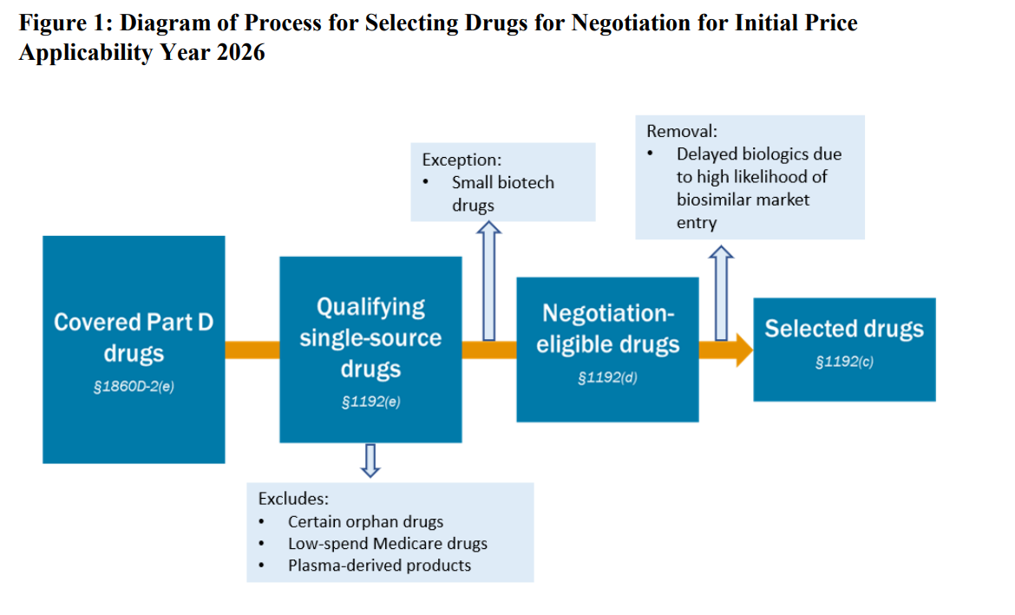

- Availability of generic drugs. When generic or biosimilars are available, MFP may not be relevant. CMS stated that they will use data from Prescription Drug Event (PDE) data and Average Manufacturer Price (AMP) to inform this decision.

- Orphan drug designation determined by FDA, not CMS. CMS will not consider withdrawn orphan designations or withdrawn approvals as disqualifying a drug from the Orphan Drug Exclusion from MFP negotiation.

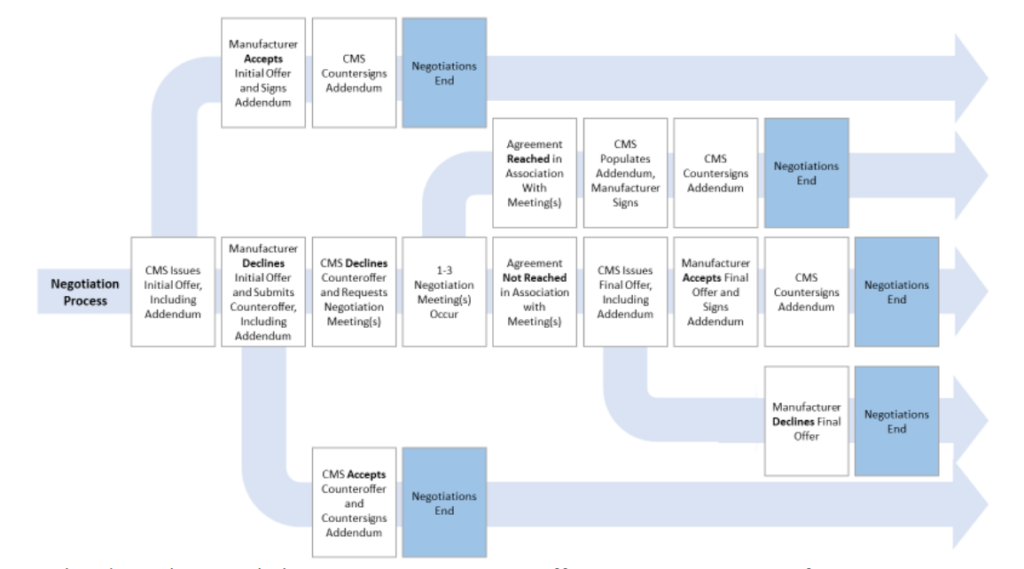

- Confidentiality of data during negotiation. CMS will not publicly discuss ongoing negotiations prior to the release of the explanation of the maximum fair price (MFP) unless a Primary Manufacturer publicly discloses information regarding the negotiation process.

- Public explanation of MFP. CMS will publish an explanation of how MFP was derived before March 1 each year prior to MFP going into effect.

- Use of clinical effectiveness and cost effectiveness to determine MFP. CMS stated “CMS reaffirmed that it will not [emphasis mine]use evidence from comparative clinical effectiveness research in a manner that treats extending the life of an individual who is elderly, disabled, or terminally ill as of lower value than extending the life of an individual who is younger, nondisabled, or not terminally ill. CMS also clarified that, for initial price applicability year 2026, it will review cost-effectiveness measures and studies that use such measures to determine whether the measure used may be considered in accordance with section 1194(e)(2) of the Act. However, while such measures may be considered, they will not [emphasis mine] be used to adjust the initial offer if the measure does not provide relevant information or is not permitted in accordance with section 1194(e)(2) of the Act and section 1182(e) of the Act.”

- Unmet medical need. CMS will consider a drug to have unmet medical need if there are “no other treatment options exist or existing treatments do not adequately address the disease or condition.” This determination will be evaluated separately for each indication. CMS’s approach will be informed by FDA guidance.

- Manufacturer-specific data. CMS modified the extensive data manufacturers are expected to submit.

The data points that CMS will consider for making adjustments to MFP beyond reference pricing will include:

- Manufacturer R&D costs. If a Primary Manufacturer has not recovered its R&D costs, CMS may 151 consider adjusting the preliminary price upwards. Conversely, if a Primary Manufacturer has recouped its R&D costs, CMS may consider adjusting the preliminary price downward or apply no adjustment

- Current unit costs of production and distribution of the drug. CMS may consider adjusting the preliminary price downward if the unit costs of production and distribution are lower than the preliminary price, or upward if the unit costs of production and distribution are greater than the preliminary price

- Prior Federal financial support for novel therapeutic discovery and development with respect to the drug. CMS may consider adjusting the preliminary price downward if funding for the discovery and development of the drug was received from Federal sources. It is not clear how this would operate since most drugs–at least in the basic science phase–received some support from Federal sources even if indirectly.

- Data on pending and approved patent applications or exclusivities recognized by the FDA, and applications and approvals under section 505(c) of the FD&C Act or section 351(a) of the PHS Act for the drug. If there are no future competitor drugs coming to market, that could impact CMS designation that the drug will continue to meet an unmet medical need.

- Market data and revenue and sales volume data for the drug in the United States. If the average commercial net price is lower than the preliminary price, CMS may consider adjusting the preliminary price downward. If the average commercial net price is greater than the preliminary price, CMS may consider adjusting the preliminary price upwards.

The full CMS guidance is available here.

[ad_2]

Source link