[ad_1]

Many people believe that the US is a fee-for-service system and many European countries are more likely to use global capitation reimbursement for providers. Those who dislike fee-for-service claim it incentivizes over-treatment and disincentives prevention and use terms like “waste” and “too expensive”. Those who dislike global capitation claim that approach leads to reduced access to care and longer wait times for care and terms used include “rationing” and “queuing”. However, the US is dipping its toe in experimenting with global capitation.

One example of global capitation payment in the US is the Pennsylvania Rural Health Model (PARHM). How does the program work? A recent paper by Scanlon et al. (2022) explains:

The Pennsylvania Rural Health Model is a $25 million, 6-year demonstration funded by the Center for Medicare and Medicaid Innovation (CMMI). Ultimately, the model will test whether global payments for the healthcare needs of a population will lead to care delivery transformation and improved quality of care and lower costs for rural Pennsylvanians.

Under the global payment, participants receive the historical net patient revenue for inpatient and outpatient hospital services for each participating payer. Part of the interest in global capitation was Maryland’s adoption of a global budget model for 10 of its rural hospitals in 2010. This system replaced the previous fee-for-service based system.

A report evaluating the first year of the program explains the model in more detail. PARM is a multi-payer initiative, which includes participation from Medicare, commercial payers, commercial payers’ Medicaid managed care and Medicare Advantage plans.

Which hospitals have joined the program?

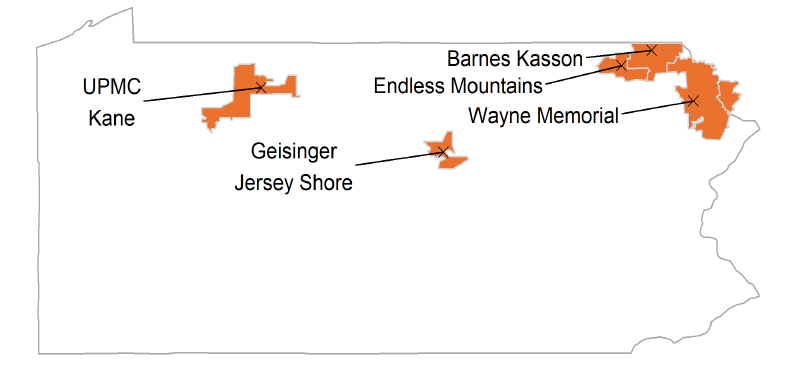

At the time of the Model announcement (2017), 67 rural hospitals, including 15 [critical access hospitals] CAHs, were eligible to participate in the Model. Five hospitals joined the Model for PY1 (2019), eight additional hospitals joined the Model for PY2 (2020), and five more hospitals joined the Model for PY3 (2021). To date, all participants remain the Model for PY3 (2021). Participating commercial payers include four Pennsylvania-based payers and one national insurer.

How were the hospitals doing before PARHM was implemented and how are they doing afterwards?

The short- and long-term financial viability of the Cohort 1 hospitals worsened during the baseline period [i.e., prior to PARHM]—a potential motivating factor for their participation in the PARHM. Declining inpatient volume and fixed costs may have negatively impacted financial performance during the baseline period…

[After the adoption of PARHM] Biweekly payments under the global budget addresses variability in payments due to seasonality and volume shifts. Hospitals perceived this as an important Model feature. During PY1 (2019), prior to final reconciliation of Medicare reimbursements, interim global budget payments exceeded the interim Medicare reimbursement amount the Cohort 1 hospitals would have been paid under FFS and cost-based reimbursement methods.

In short rural hospitals appear to be a bit better off financially under PARHM. It will be interesting to see how PARHM operated in a more dynamic environment of the COVID-19 pandemic, where costs and utilization are much harder to predict during a pandemic. On the one hand, global capitation may provide hospitals financial stability from losing revenue from elective surgeries which were deferred; on the other hand, it is unclear if PARHM–without other financial support–would have provided enough compensation to support COVID-19 pandemic related activities.

[ad_2]

Source link