[ad_1]

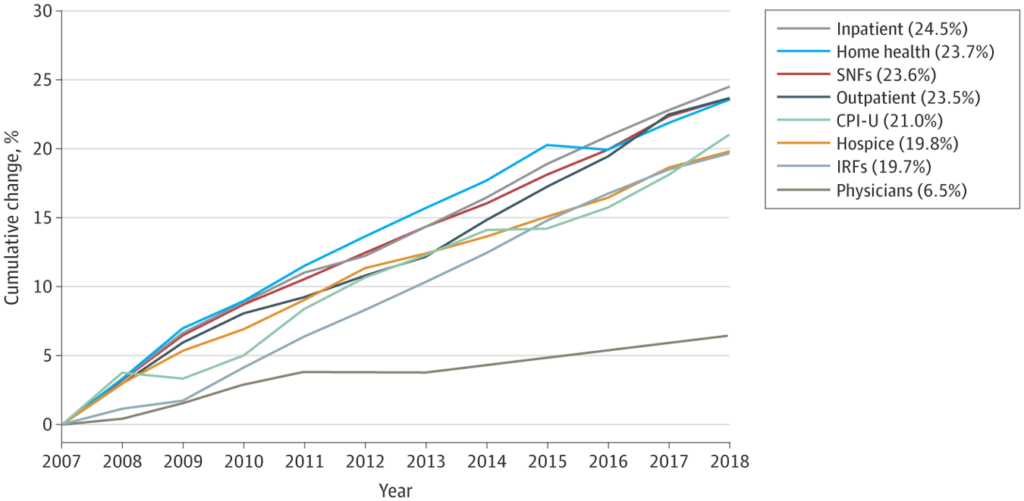

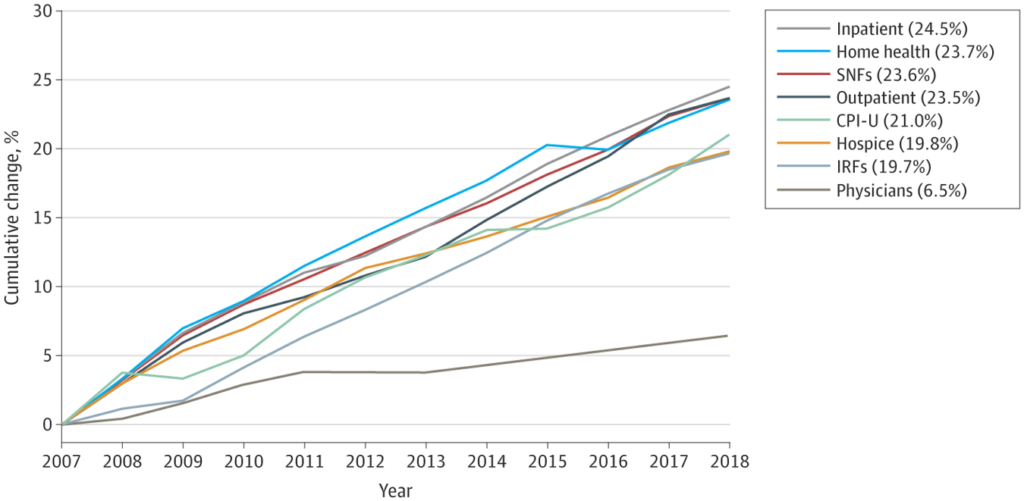

That is the question posed by Buntin et al. (2022). The authors used data from the 2007-2018 Medicare Master Beneficiary Summary File and then ran a regression adjustment to control for patient demographics (ie, age, sex), number of chronic conditions (none, 1-3, ≥4), and whether the individual had Part A or Parts A and B coverage.

Using this approach the authors found that:

Between 2008 to 2011 and 2012 to 2015, the adjusted annual Medicare Parts A and B per-beneficiary spending growth rate declined from 3.3% to −0.1%. From 2016 to 2018, the mean annual Medicare spending growth rate rose relative to the previous period but remained lower than in the baseline period at 1.7% per year. This slowdown extended across all sectors within Parts A and B, except for physician-administered drugs offered under Part B. Changes in payment rates (including sequestration measures) and beneficiary characteristics explained 44% of the difference in overall per-beneficiary spending growth between 2007 to 2011 and 2012 to 2015, and 63% between 2007 to 2011 and 2016 to 2018.

The authors find that most payment rates tracked fairly close to inflation (21.0% over this time period), but physician reimbursement only increased by 6.5%.

The authors note that their findings are consistent with the Congressional Budget Office’s finding that overall excess cost growth—or per capita spending growth above and beyond per capita GDP growth —in Medicare between 2005 and 2017 was −0.1%. In other words, Medicare spending was 0.1 percentage points lower than economic growth over this time period.

[ad_2]

Source link