[ad_1]

The Hill reports today that:

The Biden administration is rolling out a framework to enforce the government’s march-in authorities on drugs developed with taxpayer dollars, saying if drugmakers refuse to make their products “reasonably” available, then the government is prepared to give other companies license to produce those drugs at a lower cost….

If the company refuses to grant a license for its product, the government has the authority to grant the license itself. These are referred to as march-in rights, as they allow the federal government to “march in” and issue a license for a product on its own.

For politicians, seizing patents to lower drug prices may sound like a good soundbite. However, does it hold up to economic scrutiny?

My colleagues and I at FTI Consulting and I wrote a white paper–titled “The role of intellectual property in the biopharmaceutical sector“–that examined consumer, producer and societal welfare under scenarios where governments would seize patent rights for 10%, 25% or 50% of patented pharmaceuticals. The analysis found that:

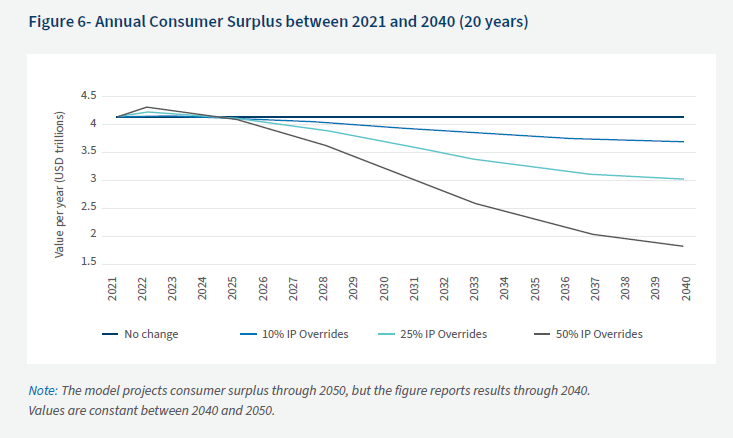

In the short term, consumers benefit from eliminating intellectual property protections because weaker protection, for instance, waiving patents, reduces prices while having only a limited impact on innovation in the short run. After only three years, however, consumers become worse off relative to the status quo and are significantly harmed in the medium to long-term.

The reason for the reduction in consumer surplus is because the threat of patent seizures results in less R&D investment and fewer drugs being developed. In fact we found that:

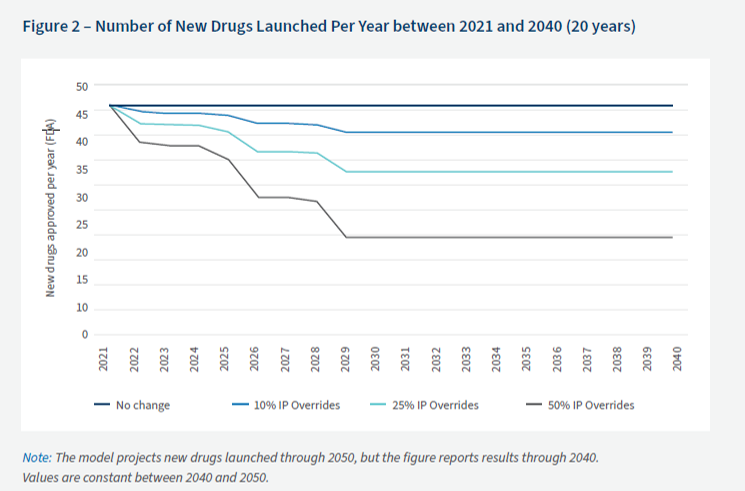

…by waiving patents for 25% of drugs, annual R&D investments would fall by 9%, 11% and 29% by the year 2023, 2025, and 2030 respectively. Overriding intellectual property for 25% of drugs would result in a reduction in the number of new drugs launched per year from 46 in 2021 to 33 in 2050.

If Biden’s march-in rights were applied broadly, the potential long-term impact on societal welfare could be massive.

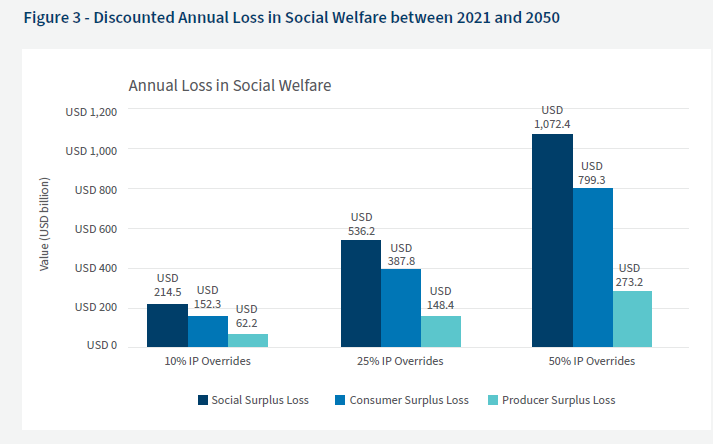

…a 25% chance of overriding a drug intellectual property protection reduces social surplus by USD 16.1 trillion (USD 536.2 billion per year on average, or 0.6% of global GDP) between 2021 and 2050.

Of course producers suffer from patents seizures as well. While many politicians focus on the impact to big pharma, failing to protect intellectual property rights also harms small biotech firms as well as universities’ with technology transfer offices (TTOs).

In short, President Biden’s focus on short-run drug prices is likely to have much larger negative implications in the medium- to long-run for patients and society.

[ad_2]

Source link