Medical debt in the U.S. is a major problem. While over 90% of individuals have health insurance, many people are uninsured and even those with insurance may be liable to high deductibles and copayments. A Kaiser Family Foundation (KFF) analysis uses data from Survey of Income and Program Participation (SIPP) and finds that:

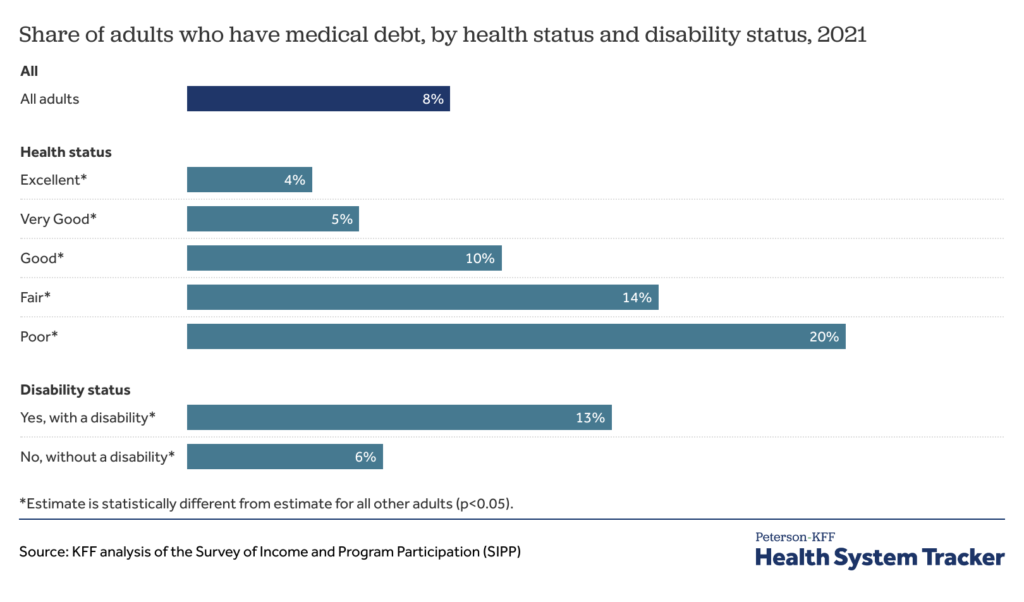

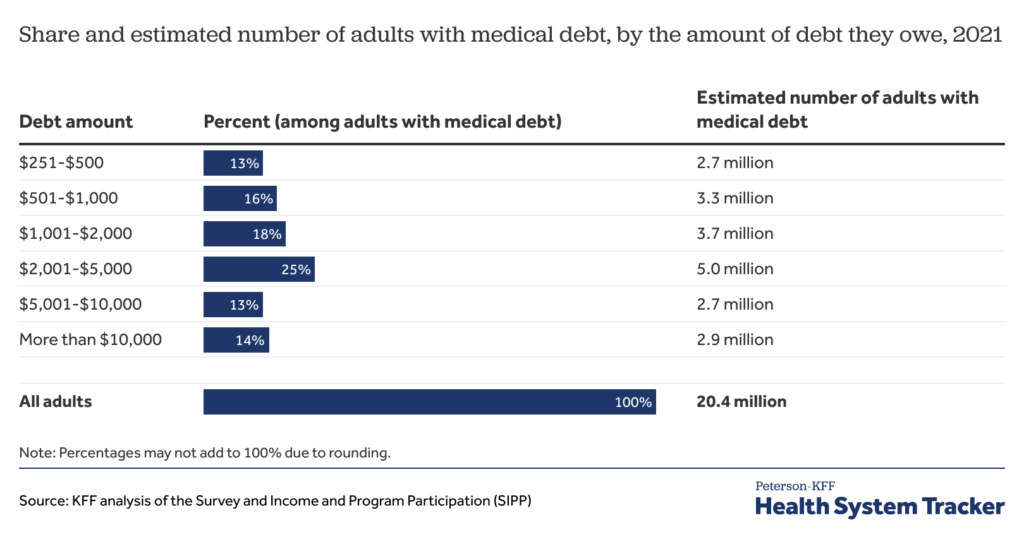

…20 million people (nearly 1 in 12 adults) owe medical debt…people in the United States owe at least $220 billion in medical debt. Approximately 14 million people (6% of adults) in the U.S. owe over $1,000 in medical debt and about 3 million people (1% of adults) owe medical debt of more than $10,000. While medical debt occurs across demographic groups, people with disabilities or in worse health, lower-income people, and uninsured people are more likely to have medical debt.

A key policy question, then, is ‘what would happen if we eliminated part or all of this debt?’ According to a paper by Kluender et al. (2024), the answer is ‘not much’.

We partnered with RIP Medical Debt to conduct two randomized experiments that relieved medical debt with a face value of $169 million for 83,401 people between 2018 and 2020. We track outcomes using credit reports, collections account data, and a multimodal survey. There are three sets of results. First, we find no impact of debt relief on credit access, utilization, and financial distress on average. Second, we estimate that debt relief causes a moderate but statistically significant reduction in payment of existing medical bills. Third, we find no effect of medical debt relief on mental health on average, with detrimental effects for some groups in pre-registered heterogeneity analysis.

The New York Times has additional coverage of this perhaps surprising result.