[ad_1]

Last September, the Pentagon’s chief software officer, Nicolas Chaillan, resigned over what he described as the Department of Defense’s poor track record on technological adoption and innovation. Chaillan later suggested that the United States has a “no competing fighting chance against China” in the race to develop dual-use technologies like artificial intelligence (AI), quantum computing, and cyber capabilities.

Chaillan’s resignation is indicative of a broader frenzy in the US national security community, which has come to see China as a “techno-authoritarian” superpower bent on reshaping global technology standards, exporting digital surveillance tools, and dominating advanced industries that will transform the future of governance, the economy, and military conflict. The director of the Central Intelligence Agency, William J. Burns, recently identified technology as the “main arena for competition and rivalry with China.”

Nowhere is the apprehension about China’s tech development more pronounced than in the debate over whether to subject US tech firms to data and antitrust regulation. Currently, several bills making their way through Congress aim to strengthen antitrust enforcement, promote data interoperability, and prevent dominant platforms from picking winners and losers in online marketplaces. A group of former US national security officials has lobbied against these bills on the grounds that they would “cede US tech leadership to China.” Former national security adviser Robert O’Brien recently wrote that passing such legislation would be “a gift to China.”

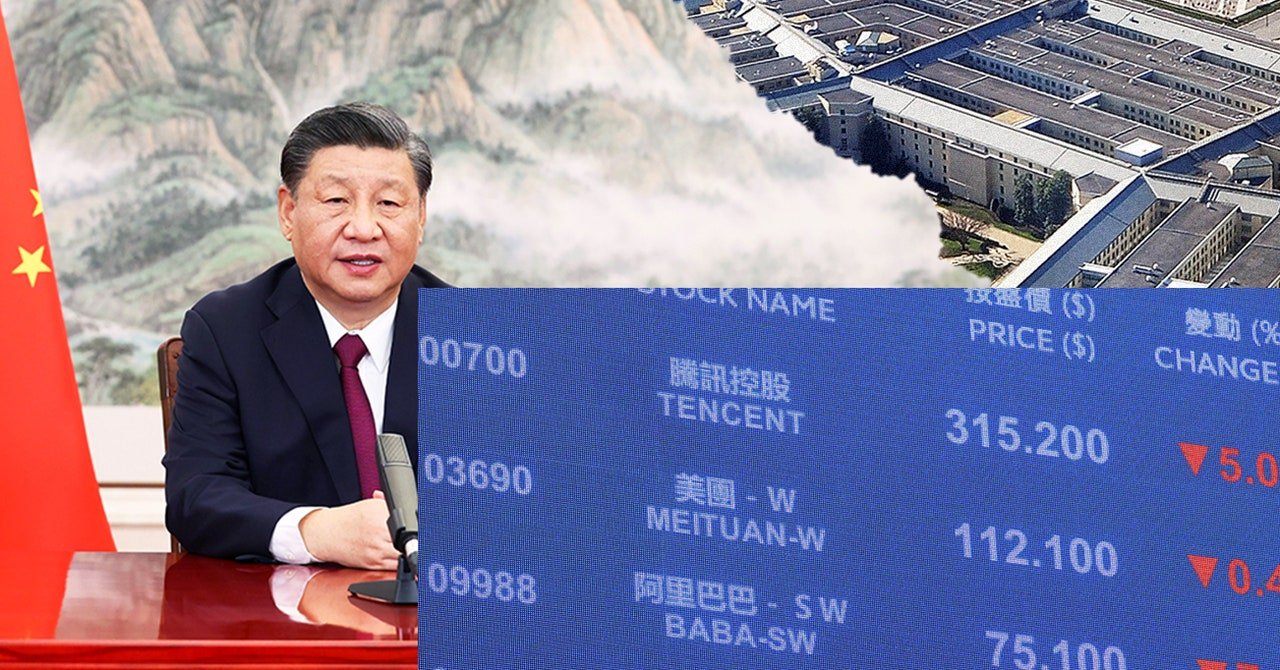

Yet at the same time that the national security community frets about changes to US tech regulation, the Chinese government is taking a sledge hammer to many of its most dominant firms — Baidu, Alibaba, Tencent, and others — damaging the short-term competitiveness and innovation capacity of its tech sector. In 2021, the market value of China’s publicly listed tech companies declined by more than $ 1.5 trillion, as the aggressive and unpredictable regulations have spooked investors. Though China’s consumer tech champions may never recover their previous market positions, there is reason to believe that, in the long run, Beijing’s regulatory measures could carve out more space for smaller firms to disrupt their larger rivals. In other words, the national security community is correct to worry about the threat from China’s tech sector, but not from its giants.

In this context, the United States should reinvigorate the competitive markets that made it a global tech leader in the first place. Rather than imitate Beijing’s costly and capricious regulatory strategy, Congress should pass standardized antitrust legislation. Two bills introduced by the House Judiciary Committee, the American Choice and Innovation Online Act and the Ending Platform Monopolies Act, would help disincentivize anticompetitive acquisitions and prevent the owners of online markets from favoring their own products. In addition, the US government would be wise to pass legislation that supports technology startups, incentivizes applied R&D investment, and promotes creative destruction in strategically important sectors.

Over the past couple of years, there has been an extraordinary divergence between the trajectories of mega-cap technology companies in China and the United States. At the same time as China’s tech industry is coming under fire, US tech companies are making record profits.

Following Chinese president Xi Jinping’s personal intervention in Ant Financial’s IPO in October 2020, the Cybersecurity Administration of China (CAC) and the State Administration for Market Regulation began to increase their oversight of online platforms and consumer internet companies. Some of China’s most well-known software firms have faced antitrust fines, forced divestitures, and IPO delays. Starved of regulatory transparency and predictability, many private businesses are foregoing long-term investments, and others have taken a hit to employment, revenue growth, and profitability. Last month, Didi, the popular-ride hailing app, suspended preparations to list publicly in Hong Kong after regulators complained that its proposals to prevent data leaks were insufficient under China’s new Data Security Law.

[ad_2]

Source link